When your car is involved in an accident, even after repairs, its value usually decreases. This reduction in resale or trade-in worth is called diminished value, and it represents a real financial loss for vehicle owners.

If the at-fault driver is insured with State Farm, you may be entitled to compensation, but navigating their claims process can be challenging.

This guide explains everything you need to know about State Farm diminished value claims, from understanding how diminished value works to gathering the right evidence to maximizing your settlement.

What is Diminished Value

Diminished value is the difference between your car’s pre-accident market value and its post-repair market value. Even if repairs are completed perfectly, most buyers will see your car as having an accident history and pay less for it compared to a similar car with a clean record.

For example, a 2020 Toyota Camry worth 20000 dollars before an accident may only sell for 16500 dollars after repairs. That 3500 dollar difference is diminished value.

Insurance companies, including State Farm, may not readily admit this loss exists, which makes it crucial for you to build a strong case.

State Farm’s Position on Diminished Value

State Farm is one of the largest auto insurers in the United States, and it often takes a conservative approach to diminished value claims.

Their stance usually includes insisting that quality repairs restore the car’s value, placing a higher burden of proof on the vehicle owner, offering a lower initial settlement, and requiring a more complex process compared to other insurers.

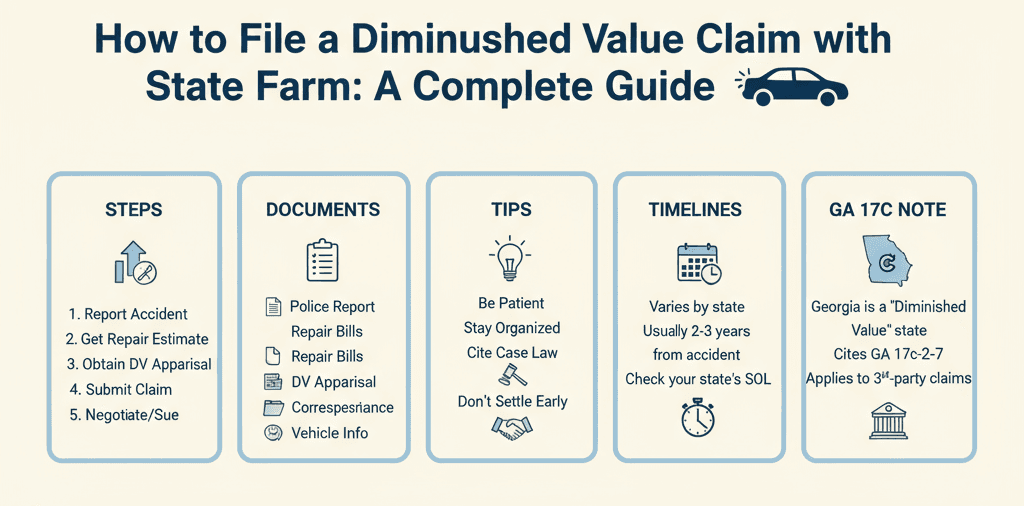

Step-by-Step Process for Filing a Diminished Value Claim with State Farm

Step 1: Gather Documentation

Before filing, collect all evidence that supports your claim. This includes the police or accident report, repair estimates and invoices, before and after photos of the damage, vehicle title and registration, and recent maintenance records.

Step 2: Get a Professional Appraisal

Hire an independent diminished value appraiser such as My Fair Claim. A professional appraisal provides a detailed market analysis of your car’s pre-accident versus post-accident value, a report that follows accepted valuation standards, and expert testimony if your claim is disputed or escalates.

Step 3: Calculate Diminished Value

At My Fair Claim, we calculate your car’s pre-accident retail value, its current post-repair value, and the exact loss in market value.

You will receive a printable diminished value report to submit directly to State Farm.

Step 4: File Your Claim with State Farm

You can submit your diminished value claim online through State Farm’s claim portal, by phone at 1-800-732-5246, by email at statefarmclaims@statefarm.com, or by mailing your documents to the nearest claims office.

Be sure to include a clear description of your claim, all supporting documentation, your My Fair Claim appraisal report, and your State Farm claim number.

Step 5: Work with the Adjuster

Once your claim is submitted, a State Farm adjuster will review your evidence, request additional information if needed, research comparable vehicles, and provide an initial settlement offer.

Tips to Maximize Your Diminished Value Settlement

Stay professional and courteous at all times, request a breakdown of how they calculated their offer, present counter-evidence if their valuation is too low, and be prepared for multiple rounds of negotiation.

Review your insurance policy carefully, understand your state’s laws regarding diminished value claims, and consider consulting an attorney if the claim is significant.

State Specific Considerations

In Georgia, diminished value claims are legally recognized, and State Farm often uses the 17c formula to calculate losses. Unfortunately, this formula usually undervalues claims. Georgia residents should carefully review the 17c formula outcome, consider legal advice if the offer is too low, and know that stronger evidence can counter State Farm’s calculation.

In most other states, diminished value claims are allowed, but each state has its own rules. Some are more consumer-friendly than others, so it is important to check your state regulations.

Timeline of a State Farm Diminished Value Claim

An initial response typically comes within one to two weeks after filing. The investigation period may take two to four weeks, depending on complexity.

Negotiations can extend for several weeks, and final resolution usually happens within 30 to 60 days.

Red Flags to Watch Out For

Be cautious if State Farm refuses to explain their calculation methods, dismisses your appraisal without proper reasoning, pushes you to accept an offer quickly, or makes a low settlement proposal without justification.

Alternative Options if Negotiations Fail

If State Farm denies or undervalues your claim, you may consider filing a complaint with your state insurance department, taking the case to small claims court for smaller losses, pursuing civil litigation for larger claims, or using mediation or arbitration if available in your policy.

Final Tips for Success

File your claim early, ideally as soon as repairs are complete. Keep all documents organized, remain persistent throughout negotiations, and make sure you understand both your appraisal numbers and the insurer’s calculations.

For large claims, weigh potential recovery against legal costs.

Conclusion

Filing a diminished value claim with State Farm can be a complex process, but with preparation, documentation, and persistence, you can achieve fair compensation. Your vehicle’s diminished value is a real financial loss and should not be overlooked.

By securing a professional appraisal from experts like My Fair Claim, presenting strong evidence, and staying patient through negotiations, you increase your chances of success. Your car deserves its true value, and you deserve to be compensated fairly.

Roger Fuentes is a certified vehicle appraiser and Director of Claims Services at MyFairClaim. With over 15 years of experience specializing in both first-party and third-party diminished value claims, Roger has successfully processed more than 2,000 claims nationwide, achieving a 94% settlement success rate.